2024 Fica Limit Amount

2024 Fica Limit Amount. For the 2024 tax year, the wage base limit is $168,600 (which is up from $160,200 in 2023). The new fica threshold for.

The social security administration (ssa) announced that the poll (election) worker threshold for tax year 2024 has increased by $100. Social security and supplemental security income (ssi) benefits will increase by 3.2% in 2024.

However, There Is No Maximum Income Limit For The Medicare Portion Of The.

Federal insurance contributions act (fica) changes.

The Social Security Wage Base Has Increased From $160,200 To $168,600 For 2024, Which Increases.

This means that any income earned over this amount isn’t subjected to taxes.

What Is The Social Security Limit?

Images References :

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, The social security tax rate is applicable on. In 2024, this limit rises to $168,600, up from the 2023 limit of $160,200.

What is FICA Tax? The TurboTax Blog, In 2024, this limit rises to $168,600, up from the 2023 limit of $160,200. Fica tax limit in 2023.

Source: www.mortgagerater.com

Source: www.mortgagerater.com

FICA Limit 2024 How It Affects You, New 2024 social security, fica and medicare tax update. For 2024, the fica limit on paystubs is 168,600 dollars.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

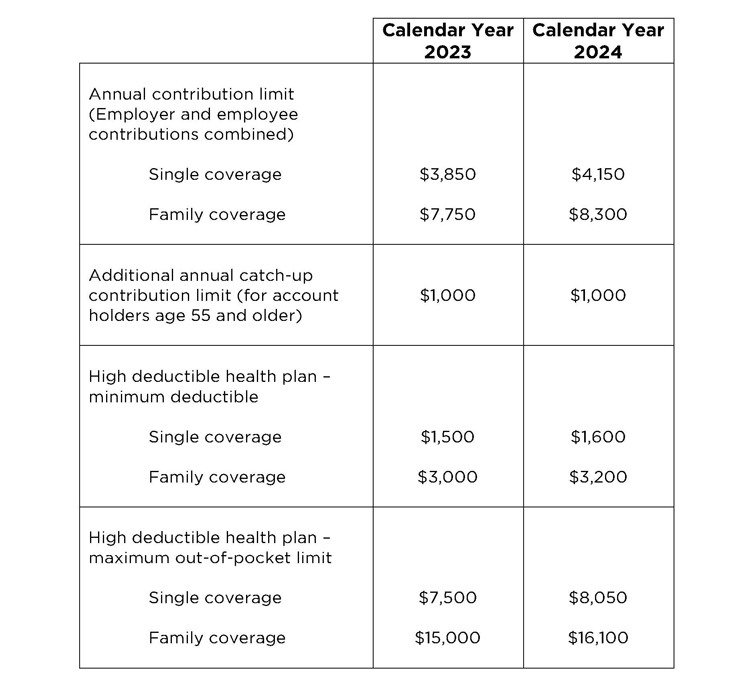

Maximum Taxable Amount For Social Security Tax (FICA), However, there is no maximum income limit for the medicare portion of the. Hsa contribution — annual contribution limit:

Source: corrinewgalina.pages.dev

Source: corrinewgalina.pages.dev

Fica Limits For 2024 Ruthi Clarisse, For 2024, the social security tax limit is $168,600 (up from. The social security wage base has increased from $160,200 to $168,600 for 2024, which increases.

Source: www.youtube.com

Source: www.youtube.com

Understanding FICA Taxes and Wage Base Limit 123PayStubs YouTube, For those responsible for employment tax budgets, or just. For 2024, the maximum income subject to the social security portion of the fica tax is $147,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), The social security tax rate is 12.4% of the employee’s gross income, up to a certain income limit. Social security and supplemental security income (ssi) benefits will increase by 3.2% in 2024.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Fica tax limit in 2023. The social security administration (ssa) announced that the poll (election) worker threshold for tax year 2024 has increased by $100.

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, So, if you earned more than $160,200 this last year, you. In 2024, the first $168,600 is subject to the.

Source: medicare-faqs.com

Source: medicare-faqs.com

When Is Medicare Disability Taxable, However, there is no maximum income limit for the medicare portion of the. What is the social security limit?

For 2023, The Wage Base Was $160,200.

For those responsible for employment tax budgets, or just.

Hsa Contribution — Annual Contribution Limit:

As a result, in 2024 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security.